Under the Australian Education Act 2013 and NSW Education Act 1990, all Approved Authorities, including Catholic Schools NSW (CSNSW), must fund schools and students according to a needs-based funding arrangement (NBFA).

In our role as the Approved Authority, CSNSW receives funding that helps educate the 127,000 primary and 100,000 secondary students who attend a school in the NSW Catholic Schools System (NSWCSS). CSNSW distributes that funding to the 11 dioceses via a Needs Based Funding Arrangement (NBFA).

What is needs-based funding?

Needs-based funding is a method that ensures funds are distributed to schools in an equitable way. This is done in accordance with legislation that supports the individual needs of a school and its students.

All schools begin with a standard amount for any student in Australia – with one amount for primary schools and another for secondary schools.

The Commonwealth Government specifies an amount known as the Schooling Resources Standard (SRS) – otherwise known as “base funding”.

How are the schools in NSW Catholic Schools System (NSWCSS) funded?

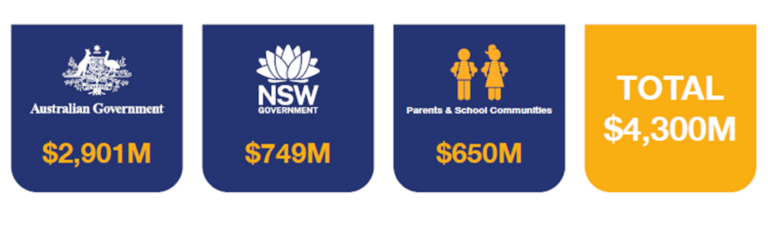

In 2024, we will receive a forecast of $4.3 billion from:

- $2.9 billion in Australian Government funding

- $749 million in NSW Government funding

- $550 million in school fees from the schools that make up NSWCSS

- $100 million in private income, donations and investments.

Schooling Resource Standard (SRS)

The government funding is based on a standard amount per student, known as ‘base funding’, or the Schooling Resource Standard (SRS).

In 2024, base funding is approximately:

- $13,557 for a primary school student per year

- $17,036 for a secondary school student per year.

Capacity to Contribute

For non-government schools, including NSW Catholic schools, the base amount of funding is reduced based on a school community’s Capacity to Contribute (CTC) to the operating costs of the school.

The CTC measures the capacity of the parents or guardians of students to contribute to the cost of educating their children. Wealthier communities receive less Government funding.

Loadings

Loadings supplement the base funding. They are additional amounts that help cover the needs of student priority cohorts and disadvantaged schools.

Loadings include:

- Students with disabilities

- Students with low English abilities

- Students of Aboriginal or Torres Strait Islander backgrounds

- Students with socio-educational disadvantages

- Small schools

- Remote schools.

On average, loadings make up approximately 24% of total funding for the NSW Catholic Schools System. However, the composition varies from school to school.

The funding calculation

The final calculation works like this.

The Catholic School’s Schooling Resource Standard (government funding) equals:

- their base funding amount

- minus the school’s capacity to contribute

- plus loadings

- multiplied by the school’s ‘legislatively determined transition share’.

How are the funds distributed?

After CSNSW receives the recurrent funding from government, funds are distributed to its almost 550 systemic schools via a 2-step process:

- Step 1: As an Approved System Authority, we centrally pool all government funds before distributing them to the 11 Diocesan Schools Systems (DSS) within NSW.

- Step 2: The 11 Diocesan Schools Offices (DSO) then deploy or allocate the funds to each of the schools within their dioceses.

Each diocese determines how they allocate the funds to their schools, based on local knowledge of the school and its community. They are best placed to understand each school’s individual needs.

How is the funding used?

The funding we distribute to schools is spent – or committed to be spent – on eligible school-related items in the year it’s received.

Funding covers schools' operations, including:

- salaries – principals, teachers and support staff

- operating costs – including administration, marketing, IT and accounting

- property expenses – including maintenance and utilities

- debt servicing costs

- capital equipment.

Funding for capital projects such as new buildings or other major infrastructure projects are funded mainly from parent fees and other contributions.

Want to know more?

For a more detailed overview of funding arrangements download the NSW Catholic Schools System Needs-Based Funding Arrangement.

How many students make up the NSW Catholic Schools System?

Catholic Schools NSW educates approximately:

- 127,000 primary school students

- 100,000 secondary school students

- across close to 550 schools in the NSW Catholic Schools System.

How does a school within the NSW Catholic Schools System differ from a non-systemic Catholic school?

Local Diocesan Schools Offices operate NSW Catholic schools in their area.

Non-systemic Catholic schools are operated by either:

- a religious order or

- a Public Juridic Person (a Catholic legal entity established for school governance purposes).

The Government directly funds non-systemic Catholic schools.

Who pays for a child’s education at Catholic schools in NSW?

Responsibility for funding the cost of education is shared by the Australian Government, the NSW Government and by parents and school communities.

In 2024, CSNSW will receive a forecast $3.65 billion in recurrent funding from the Commonwealth and NSW State governments. NSW Catholic Schools System schools will also raise an estimated $550 million from school fees and $100 million from other private income sources, including donations and investments.

How is the amount of base funding determined?

This is known as the Schooling Resource Standard (SRS) and is indexed annually. The government estimates that the minimum cost to educate a child in an Australian school in 2024 is $13,557 for a primary school student and $17,036 for a secondary school student.

How is the Capacity to Contribute calculated?

The government calculates a school’s Capacity to Contribute (CTC) with reference to a Direct Measure of Income (DMI).

The taxable income of the parents and guardians of the school’s students defines the DMI.

The Australian Government Department of Education collects the DMI data from the Australian Taxation Office and other government agencies’ records.

The data:

- identifies the median (middle) family income from all family incomes within a school

- ranks the median incomes calculated for all non-government schools

- converts the ranked median incomes into a set of DMI scores.

An average of DMI scores over three years determines a CTC score for each school.

Schools with the lowest CTC scores get 90% of the SRS, while schools with the highest CTC scores get 20% of the SRS.

Why is funding calculated using a needs-based arrangement?

Legislation requires that a needs-based arrangement applies to school funding.

However, our Funding Distribution Model also tries to equitably meet the individual needs of schools and students.

We distribute the government funding we receive in line with the needs-based principle, as determined by the funding legislation.

Does needs-based funding cover the cost of running a school?

In addition to recurrent funding for their day-to-day operations, schools typically require further resources. These are used for additional needs such as buildings, (classrooms, libraries, and sports facilities). This additional funding can be raised from other sources, including school fees.

What do you do with unspent funding?

Schools spend (or commit to spend) all government recurrent funding on school operations in the year it’s received.

Is CSNSW accountable to governments for how it uses its funding?

We are committed to transparency and accountability when it comes to how CSNSW manages and uses the government funding it receives. As part of our regulatory responsibilities, CSNSW submits annual funding reports to both the Australian and NSW Governments and is subject to comprehensive oversight regimes by the NSW and Commonwealth Departments of Education.